Board games at Christmas are the perfect way to have fun with the family and let that festive feast settle.

And a recent survey by GAME proves that the classic games are still the best.

Monopoly took the top spot as the best Christmas game for families. The British video game retailer found that 37% of participants play the game over the festive season.

The real estate investment game beat other classic games, such as Trivial Pursuit, which received 15% of the votes.

However, it is far from the perfect holiday game, as it is the one most likely to cause an argument. In fact, more than a third (35%) said the game is responsible for squabbles with family.

There is no doubt the game can cause a little frustration. But with our eight tips and strategies, you can give yourself the edge this Christmas.

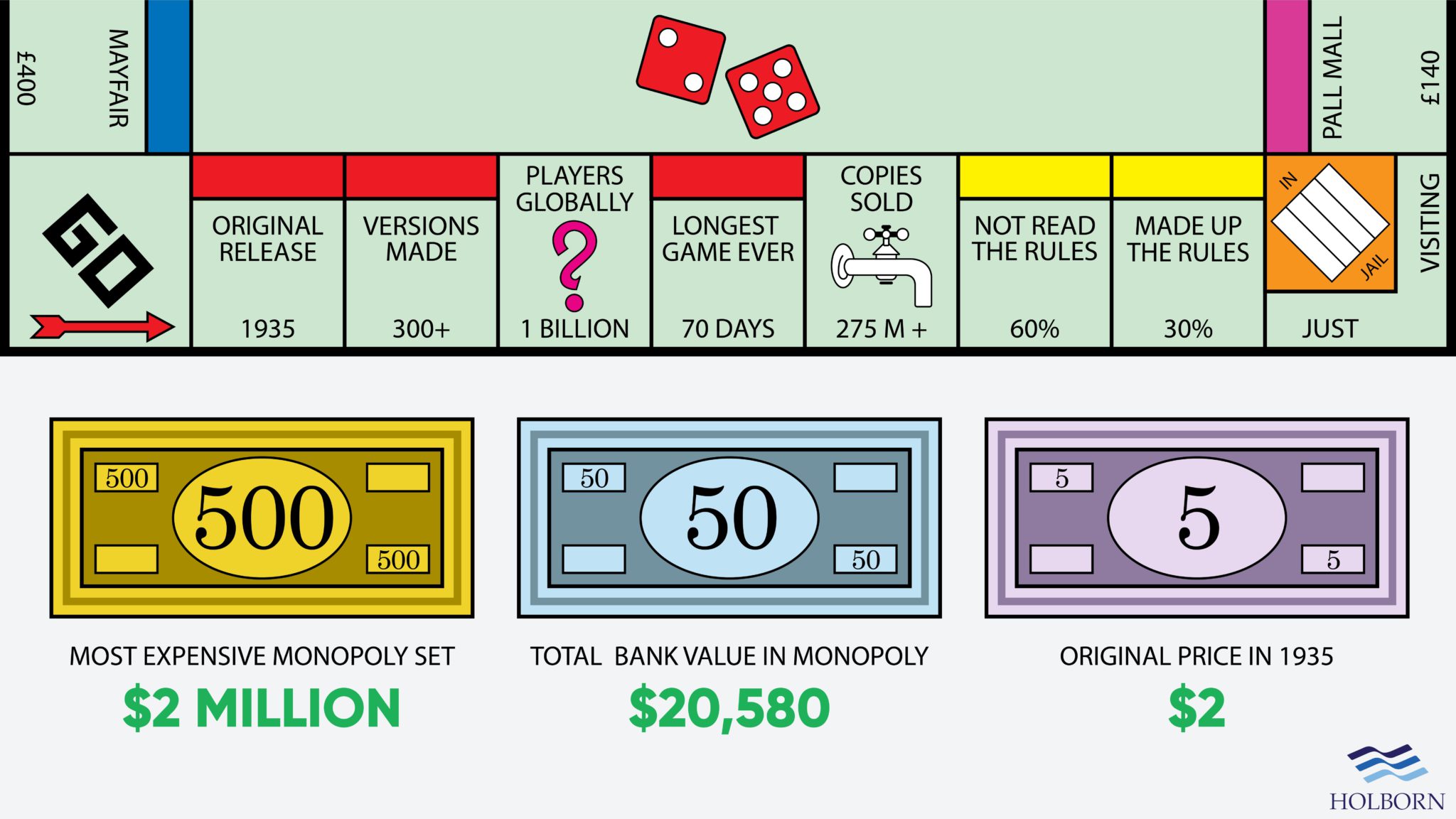

But first, let’s look at some fun Monopoly facts that you can use around the dinner table over some turkey. After all, anything beats a Christmas cracker joke, right?

Monopoly Christmas crackers

Monopoly has undoubtedly stood the test of time, with the original game being released in 1935.

Here are some fun facts about the classic family favourite board game.

8 top tips to help you win Monopoly

1 – Start strong

A big mistake people often make is avoiding smaller properties. Instead, they save their money for the more expensive options further around the Monopoly board.

A slow and steady approach will often cost you the game, so don’t save money. Instead, invest your money early and reap the rewards later in the game.

2 – Buy red and orange

Did you know that statistically, red and orange properties are landed on the most?

With that in mind, it’s a good idea to snap up these properties as early as possible. Doing so means you collect more rent and increase your chances of winning.

3 – Buy railroads

Owning all four of the railroads can increase your chances of winning. Once you have all of them, you have the opportunity to pocket money from all four sides of the board.

You may want to buy all of them, or at least one, to stop the other players from owning all four.

4 – Avoid utilities

Railroads offer better investment returns than utilities. Plus, there are only two utilities, meaning there is only a 1 in 36 chance you will profit from them.

5 – Three houses are better than one

Make it your number one priority to get three houses on your monopolies.

The price difference between one and three houses is huge. Having three houses will punish a player who lands there and increase your overall income, increasing your chances of winning the game.

6 – Create a housing shortage

This is an excellent strategic move.

There are only 32 houses available. The more you have, the less your opponents can buy. There are two benefits to doing this.

You will earn more money every time someone lands on your property, but you will also limit their capacity to make money. It also stops them from building hotels.

A hotel requires four houses. Getting four is difficult for your opponents if you are buying all of the houses. It’s an effective strategy, but it may cause a few arguments.

7 – Statistics are your friend

You probably didn’t realise this, but you can actually use statistics to gain the upper hand over your opponents. There are a few statistics to be aware of that can help you play a more intelligent game.

First, Monopoly is typically played using two dice. This means you have the highest odds of rolling a 7, with 2 and 12 being the least probable. With this in mind, you can invest in properties seven squares away from your opponent’s current position on the board.

Some other interesting statistics that can help you play smart include:

On average, it takes between five and six dice rolls to get around the board. With 28 of the 40 squares being properties, you will likely land on four within a single rotation.

There is a 17% chance of rolling doubles, meaning you will probably roll one for every six turns. This means you are likely to roll one double for every lap of the board.

8 – Going to jail can be a good thing

In Monopoly, going to jail is usually a bad thing, and you’ll want to get out as quickly as possible.

However, staying in jail can work to your advantage in the latter stages of the game. At this point, the board will be filled with multiple houses and hotels.

By staying in jail for three turns, you avoid potentially landing on your opponent’s properties and having to pay them large amounts.

The real-world lessons of Monopoly

You’ve followed the tips above and taken down the competition. But Monopoly is more than a fun game (or annoying if you are not winning).

The game actually teaches us a lot about real-world finance and even real estate investments. Here are some key lessons the board game teaches us that can help you improve your real-world financial situation.

1 – Expensive isn’t always the best option

Players often prioritise expensive options such as Mayfair.

The trouble is, these options don’t always provide the best return on your investment; the same is true in the real world. This is especially true when applied to real estate investing.

For real estate investors looking to buy a rental property, capital growth and rental yield are the key factors determining the overall return.

Based on the latest data from the Land Registry House Price Index, the average house price in the UK stands at £296,422. However, some of the best-performing locations in 2022 for capital growth also have average property prices below the UK average.

A report by Halifax found that property prices in Sheffield had increased by 18.9 on average. Despite the increase, the average house price in the city was just over £228,000 – around £68,000 below the national average.

Other UK cities, such as Manchester, also saw much better growth than London and other locations with steeper property prices.

2 – Saving vs investing

When playing Monopoly, it’s all well and good having money in the bank, but if you are not investing it, you’re not setting yourself up to win.

In the current climate, even the savings accounts offering the best rates won’t help your money beat the inflation rate. As a result, your money actually loses value over time.

Investing gives your money the best chance to grow over time. While all investments have a level of risk, having the right strategy in place can help mitigate risk.

3 – Revenue streams

Beating your fellow players at Monopoly requires multiple revenue streams to help you build your cash.

Having multiple properties around the board helps increase cash flow as a player is more likely to land there and have to pay you rent. It’s a similar story in the real world.

Successful investors will only have some of their wealth tied up in one asset. You can create multiple revenue streams by using different saving and investment options.

And this leads us nicely to our last point – diversification.

4 – Diversify

You won’t win many games of Monopoly if you are too reserved with your purchases. On the flip side, buying everything on the board is not the best strategy.

In other words, putting all of your eggs in one basket will yield the same results as spreading yourself too thin. The same rule applies to investing, which is why creating a diverse portfolio is essential.

By investing in a diverse range of assets, you can better manage the risk/reward of your investments. Mutual funds and exchange-traded funds (EFTs) are ready-made baskets of securities and a great way to quickly diversify.

Start 2023 strong

Now you’ve learned how to increase your financial standing in Monopoly, it’s time to transfer that success to the real world.

You don’t have to wait until the new year to start planning. Book a free financial review with Holborn and start 2023 strong.

From everyone at Holborn Assets, we wish you a merry Christmas and happy gaming this festive season.

Disclaimer:

Monopoly wins are not guaranteed based on the advice above.

Arguments may ensue when implementing the tactics mentioned within this article. Holborn Assets can not be held responsible for any conflicts, boards being flipped or all-out rage quitting by your opponents.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences