The Ultimate Guide to Wealth Management

Wealth management is a comprehensive service that helps you grow and preserve wealth to create a more secure financial future.

Holborn Assets are one of the leading financial advisory groups around the globe. We specialise in providing quality, independent financial advice and wealth management solutions to the expat market. We manage over $2billion AUM for 20,000+ clients around the world and offer award-winning financial advice services for expatriates and high-net-worth clients in the 18 countries we operate in.

Whatever stage of your financial journey you're currently in, speak to us today and we can help.

What is wealth management?

Official figures show that personal wealth is increasing globally. In 2002, there were 7.7 million high-net-worth individuals (HNWIs) worldwide. By 2022, that number increased to 22.5 million.

And as wealth grows, so does the need to manage and protect it effectively. And that is where wealth management comes into play.

Wealth management is a holistic service designed to help clients across all aspects of their financial life. A wealth manager can offer services such as:

- Tax planning

- Investments expertise

- Asset and portfolio management

- Retirement planning

Read our what is wealth management guide to learn more.

Wealth management in Dubai

Around 68,000 high net-worth individuals (HNWIs) live in Dubai. Those with a high net worth typically have different needs and require a different approach to managing their money.

For global citizens living in Dubai, wealth management can help them overcome complex financial implications such as tax.

If you live in Dubai and want to know how you could benefit from wealth management services, read our wealth management in Dubai guide to learn more.

Why you need a wealth management strategy

A wealth management strategy is a personalised action plan for your money. It is a vital tool for those with complex financial needs to ensure their money grows and remains protected.

By effectively managing your assets and other areas of your financial life, a wealth management strategy can help you reach your goals and objectives.

Want to know more? Read our 'why you need a wealth management strategy guide' to learn more.

Ready to speak to a specialist?

Start your journey with Holborn Assets

The benefits of wealth management services

Wealth management is a comprehensive approach to financial planning. It provides the tools and knowledge needed to secure your financial future.

A wealth manager can help you optimise your wealth and make reaching your short-term and long-term goals much more straightforward.

Read out in-depth guide to learn more about the benefits of wealth management services.

Wealth management for families

For high-net-worth families, transferring wealth to future generations can be complex and have significant tax implications.

Family wealth management is a service that establishes a framework, allowing you to pass on your assets to future generations in the most efficient way possible.

To learn more, read our comprehensive family wealth management guide.

What is the difference between wealth management and asset management?

While wealth management and asset management share some similarities, each has a different purpose. Understanding the difference between the two can help you better determine which is best suited to you and your goals.

Are you unsure what service is right for you? If so, read our guide on the difference between wealth management and asset management.

Do I need a financial adviser or a wealth manager?

Anyone can benefit from professional financial advice. But knowing what type of professional better suits your needs can be challenging.

Wealth managers and financial advisers both provide the tools and insight needed to reach your goals. And while the line between the two is often blurred, both offer different services.

Understanding the difference between wealth managers and financial advisers is the first step to finding the right person to help you.

Our guide will help you determine if you need a financial adviser or wealth manager.

How to choose the right wealth management firm

With so many wealth management firms out there, knowing how to choose the right one can be challenging.

But finding the right wealth manager to handle your finances is essential. After all, you are trusting this person to help you make financial decisions that are in your best interests.

If you are unsure what to look for, our guide has everything you need to know to help you choose the right wealth management firm.

Wealth management for HNWIs

Globally, the number of HNWIs has increased by 109% over the last 20 years. And as wealth increases, you often outgrow standard financial vehicles and services. For example, a HNWI may need to consider a more competitive option, such as private banking, when a retail bank no longer meets their needs.

Wealth management for HNWIs provides the support and holistic approach needed to ensure their wealth continues to grow and remains protected.

Services such as wealth management tax planning help minimise the tax burden, maximise growth and ensure your assets are passed on in a tax-efficient manner. Meanwhile, wealth managers will develop an effective risk wealth management strategy to help you avoid the potential perils and pitfalls that come with managing your wealth.

Wealth management supports you through different stages of life, including retirement. And with the time spent in retirement increasing, planning accordingly is essential. Planning for retirement with wealth management will help ensure you are financially prepared to live the life you want when you decide to stop working.

Finding the right approach to personal finance

Although wealth managers often work with HNWIs, it does not mean their services are exclusively reserved for the wealthy. Anyone with complex financial needs can benefit from wealth management services.

But not everyone needs a comprehensive approach to managing their money. Depending on your needs and goals, there may be better options. That's why finding the service that best fits your needs is essential.

Wealth management and financial planning are both closely related. Both help you create a roadmap, helping you reach your goals and objectives. While the two share some similarities, both have different use cases.

To learn more and determine what option is right for you, read our guide to wealth management and financial planning.

Read more about Wealth Management

The Benefits of Wealth Management Services

Wealth management is a comprehensive service that helps individuals and...

How to Choose the Right Wealth Management Firm

As your wealth grows, so do the challenges of managing it.

How to Manage Risk With Wealth Management?

Risks and their consequences come in all shapes and sizes.

Read more about Wealth Management

The Benefits of Wealth Management Services

Wealth management is a comprehensive service that helps individuals and...

How to Choose the Right Wealth Management Firm

As your wealth grows, so do the challenges of managing it.

How to Manage Risk With Wealth Management?

Risks and their consequences come in all shapes and sizes.

Planning Retirement Through Wealth Management

Did you know the average person may need to plan for two decades of retirement?...

Tax Planning and Wealth Management

Whether you want to grow or preserve your wealth, tax can be one of the biggest...

Wealth Management and Financial Planning

Using the right tools for the right job can make all the difference.

Family Wealth Management

Contrary to popular belief, having significant wealth in the family doesn't...

Wealth Management for High-Net-Worth Individuals

As a high-net-worth individual (HNWI), it’s easy to assume that your finances...

Wealth Management in Dubai

Dubai has nearly 68,000 high net-worth individuals (HNWIs), according to a...

Wealth Management or Asset Management?

Growth is not a straight line. Building wealth over time is the result of...

Wealth Management or Private Banking

Do you understand the difference between private banking and wealth management...

Do I need a Financial Adviser or a Wealth Manager?

Here's a question for you: Android or iPhone?

What is Wealth Management?

When asking the question, "What is wealth management?", it's important to start...

Why you need a wealth management strategy

Think of your wealth as a snowball rolling down a hill.

The Benefits of Wealth Management Services

Wealth management is a comprehensive service that helps individuals and...

How to Choose the Right Wealth Management Firm

As your wealth grows, so do the challenges of managing it.

How to Manage Risk With Wealth Management?

Risks and their consequences come in all shapes and sizes.

Planning Retirement Through Wealth Management

Did you know the average person may need to plan for two decades of retirement?...

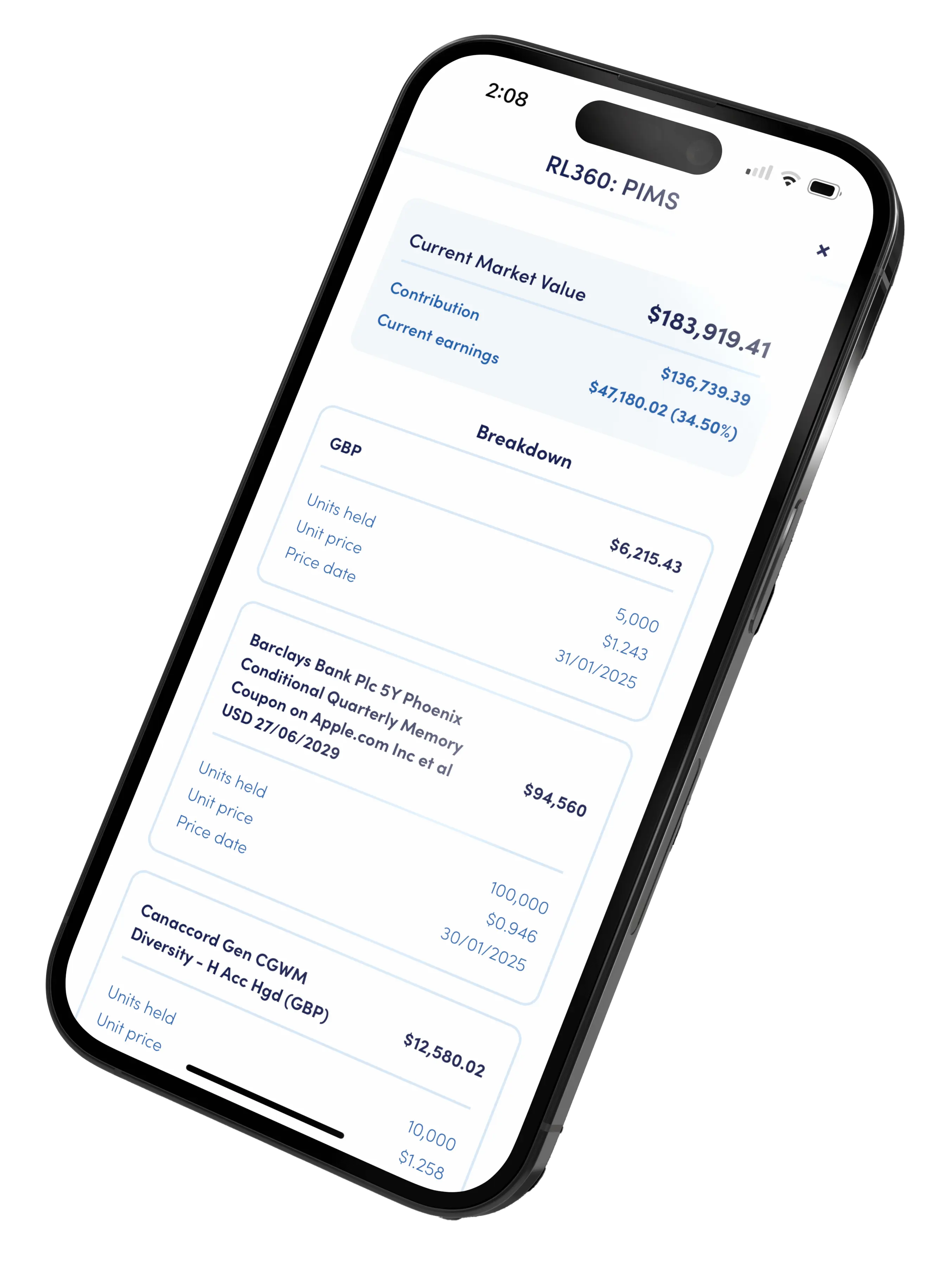

Manage your wealth with the Holborn app

Track your investments, monitor your portfolio performance, and manage your financial documents securely, all in one place.

Get real-time insights, easy access to your portfolio, and tools that keep your wealth strategy on track, wherever you are.