Pensions

Pensions are a core component of any retirement planning strategy and provide a tax-efficient way of saving for retirement.

Holborn Assets is one of the leading financial advisory groups around the globe. We specialise in providing quality, independent financial advice and wealth management solutions to the expat market.

We manage over $2 billion AUM for 20,000+ clients worldwide and offer award-winning financial advice services for expatriates and high-net-worth clients in the 18 countries we operate in.

Whatever stage of your financial journey you're currently in, speak to us today, and we can help.

Introduction to pensions

The closer we get to retirement age, the more important it is to ensure we are prepared financially. That is why a regular pension review with a qualified pension expert is crucial.

A pension review is a proactive way of ensuring your retirement plans are on track and that your pension performs at its best. It can also help identify potential gaps and changes you might benefit from.

To learn more, read our pension reviews guide.

Pension advice for expats

Research shows that for 60% of expats, saving for retirement is one of their top 3 goals. However, 52% said their finances are complex due to their tax situation.

For those living, working or planning to retire abroad, the retirement planning process can be more complex, and there is a lot more to consider.

That is why seeking tailored pension advice is crucial. It can help overcome some of the challenges of retirement planning as an expat.

To learn more, read our expat pension advice guide.

Understanding the different types of pensions

With so many pension products on the market, understanding which one is right for you can be challenging.

Below is an overview of some common types of pensions and pension products.

QROPS:

A qualifying recognised overseas pension scheme (QROPS) is an overseas pension scheme that satisfies the rules set out by HMRC. They are allowed to receive transfers from UK-registered pension schemes. QROPS are typically used by those who plan on retiring overseas and want to take their pension pot with them. Read our guide to QROPS to learn more.

SIPP:

A self-invested personal pension (SIPP) is a type of defined contribution pension. With a SIPP, you are responsible for the investment decisions. This gives you greater control and flexibility over your pension savings. SIPPs can also provide tax advantages and a broader range of investment choices. Read our guide to SIPPs to learn more.

QNUPS:

A qualifying non-UK pension scheme (QNUPS) is an overseas pension scheme with no residency restrictions. It can be used by UK and non-UK residents. A QNUPS can provide numerous tax benefits. The main one is that it can allow you to legally avoid Inheritance Tax (IHT). Current or returning UK residents can also transfer a Universal life insurance policy to a QNUPS and reduce the tax burden when drawing money from the policy's cash value. For a more detailed breakdown, read our guide to QNUPS.

UK State Pension:

The UK State Pension is a regular payment made by the government once you reach a certain age. While the State Pension alone is unlikely to provide enough retirement income to support you financially, it can cover essential expenses such as general living costs. Read our guide to the UK State Pension for a more in-depth look.

Defined benefit pensions:

Official data shows that around 8 in 10 eligible employees now have a workplace pension. A defined benefit (DB) pension is one of the two main types of workplace pension. It pays a guaranteed income once you reach retirement age. Read our guide on defined benefit pensions, where you will find all the essential information you need.

Workplace pensions:

A workplace pension scheme is set up by your employer. Both you and your employer usually pay into the pension, and contributions are deducted directly from your salary and paid into your pension pot. Workplace pensions benefit from tax relief on contributions, meaning they provide a tax-efficient way to save for retirement. There are two main types of workplace pensions: defined contribution (DC) and defined benefit (DB) pensions. Read our comprehensive guide to workplace pensions to learn more.

Ready to speak to a specialist?

Start your journey with Holborn Assets

Pension transfers

A pension transfer is the process of moving your pension savings from your current scheme to a new scheme or provider.

Pension transfers can provide several benefits, such as combining multiple pensions into one easy-to-manage pot. Expats may also benefit from transferring their pension if they intend to retire overseas.

While most pension types can be transferred, it is recommended that you speak with a pensions specialist first to better understand your options.

To learn more, read our guide to pension transfers.

Pension consolidation

Pension consolidation is the process of combining all or some of your existing pensions into one pot.

Consolidating your pensions can provide several benefits, such as making your retirement savings easier to manage and reducing fees and costs.

Read our guide on pension consolidation to learn more.

Your questions, answered

For those who wish to retire abroad and take their pension with them, there are three main options – QROPS, SIPPs and QNUPS. Each one has different benefits and use cases. Understanding which option is right for you can be complex. For a detailed breakdown of each and their use cases, read our guide on the difference between QROPS, QNUPS and SIPPS.

Pensions are a regular income source, and help provide financial stability when we stop working. And while pensions can benefit from tax relief, they are not exempt from tax. How much tax you pay will depend on several factors, such as your annual taxable income. For a comprehensive overview, read our guide to tax and pensions.

From workplace pensions to stakeholder and personal pensions, there are no limits to how many pensions you can set up. While there is no limit to the number of pensions you can have, there are some essential things to consider, such as tax liabilities, costs and fees. Read our guide on having multiple pensions to learn more.

There are multiple ways to boost your pension income. Some of these include combining your pension pots, increasing pension contributions and maximising tax relief benefits. You could even consider supplementing your pension with a passive income. Read our detailed pension growth guide to learn more about boosting your retirement income.

Read more about Pensions

Defined Benefit Pensions Guide

Workplace pensions are the cornerstone of retirement planning.

Difference Between SIPPs, QROPS & QNUPS

According to research funded by the OECD, nearly five million British nationals...

Expat Pension Advice

Planning for the future is vital. But things are not always straightforward for...

Read more about Pensions

Defined Benefit Pensions Guide

Workplace pensions are the cornerstone of retirement planning.

Difference Between SIPPs, QROPS & QNUPS

According to research funded by the OECD, nearly five million British nationals...

Expat Pension Advice

Planning for the future is vital. But things are not always straightforward for...

Guide to Pension Consolidation

"Don't put all of your eggs in one basket."

Guide to Tax and Pensions

Pensions are a core component of any retirement planning strategy.

How Do I Grow My Pension?

While change is inevitable, growth is often intentional.

How Many Pensions Can I Have?

Your pension is the cornerstone of your retirement savings and is crucial in...

Pension Review

The closer you are to retirement, the more important it is to be financially...

Pension Transfers

Pensions are the cornerstone of retirement planning, providing financial...

QNUPS

A QNUPS can provide more flexibility and control over your assets, as well as...

QROPS

Building up enough retirement savings and setting yourself up financially...

SIPPs

The more control we have in a given situation, the more we can affect the...

UK State Pension

The UK State Pension provides a vital foundation for your retirement income.

Workplace Pensions

One of the core components of a financially secure retirement is a workplace...

Defined Benefit Pensions Guide

Workplace pensions are the cornerstone of retirement planning.

Difference Between SIPPs, QROPS & QNUPS

According to research funded by the OECD, nearly five million British nationals...

Expat Pension Advice

Planning for the future is vital. But things are not always straightforward for...

Guide to Pension Consolidation

"Don't put all of your eggs in one basket."

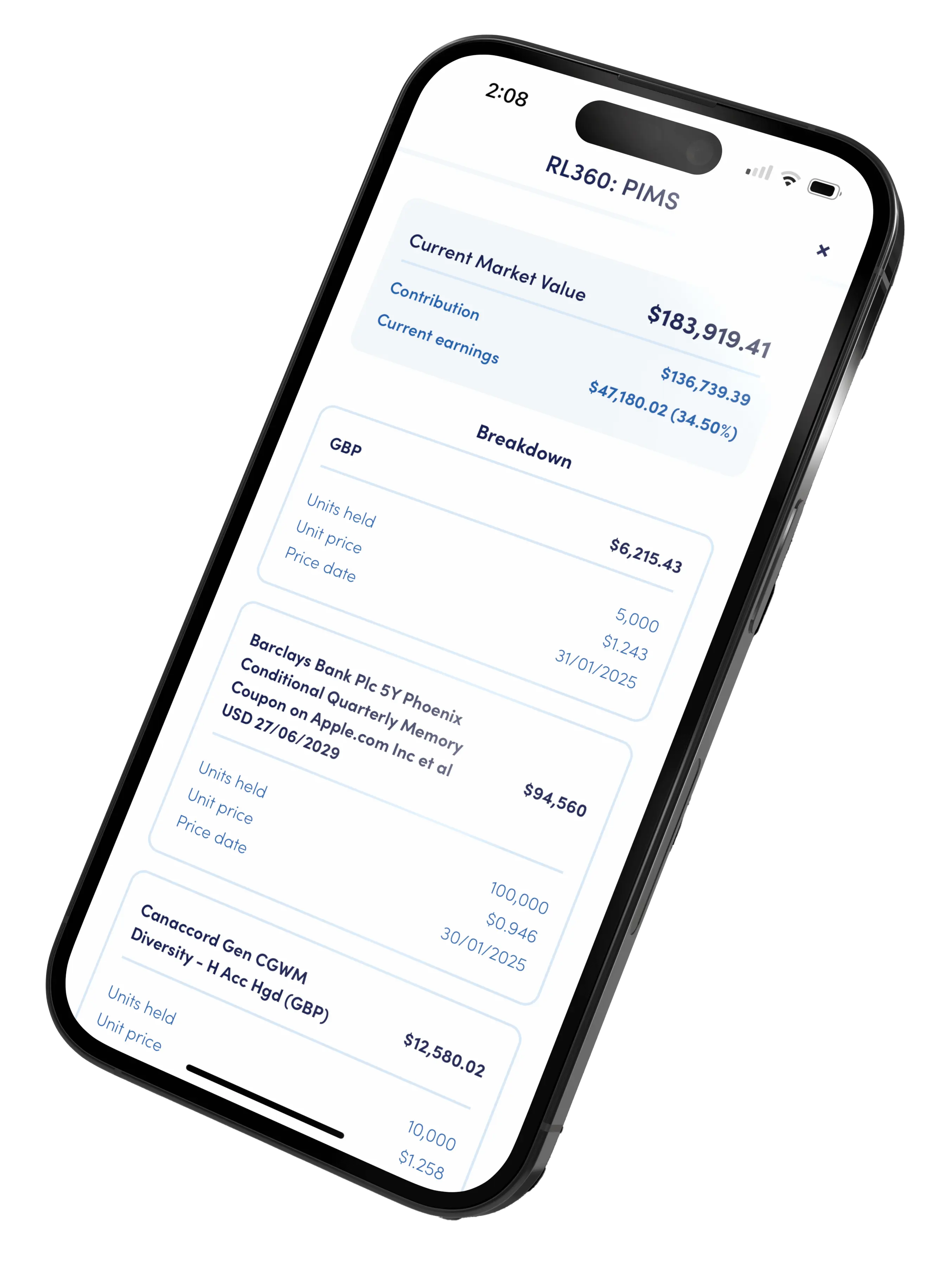

Manage your pension with the Holborn app

Track your pension value, monitor your portfolio performance, and manage your financial documents securely, all in one place.

Get real-time insights, easy access to your pension, and tools that keep your retirement strategy on track, wherever you are.