Critical Illness Insurance

Financial security when you need it most.

Critical illness cover provides security so you can focus on your health without worrying about your finances.

Don’t Be Caught Off Guard

A serious diagnosis can turn your world upside down. Suddenly, medical bills, appointments, and missed work can threaten your financial stability.

When facing a critical illness, worrying about money should be the last thing on your mind. That’s where critical illness insurance comes in.

Critical illness cover acts as a financial safety net. It provides a tax-free lump sum if you’re diagnosed with a covered illness such as cancer, heart attack, or stroke.

Your payout can help with everyday bills, medical costs, and lost wages, so you can focus fully on your health and recovery.

Why choose Holborn for critical illness cover?

Personalised Advice

Talk to an experienced adviser who will explain your options clearly and support you throughout the process.

Comprehensive Cover

We’ll help you find the right critical illness cover based on your lifestyle, financial goals, and medical needs.

Market-Leading Policies

As an independent company, we are not tied to one insurer. Our policies are supported by top insurance providers, so you can be sure you’re in safe hands.

The benefits of our critical illness insurance

Tax-free payout

Receive a tax-free lump sum if you are diagnosed with a critical illness covered by your policy.

Freedom

Use the lump sum payment for anything you need, like medical treatment or household bills.

Flexibility

Choose a policy term length that suits your personal circumstances.

Cover for children

Some policies include children’s critical illness cover at an extra cost.

Comprehensive protection

Combine critical illness and life insurance for all-round financial security.

About our critical illness insurance

The Benefits

Tax-free payout:

Receive a tax-free lump sum if you are diagnosed with a critical illness covered by your policy.

Freedom:

Use the lump sum payment for anything you need, like medical treatment or household bills.

Flexibility:

Choose a policy term length that suits your personal circumstances.

Cover for children:

Some policies include children’s critical illness cover at an extra cost.

Comprehensive protection:

Combine critical illness and life insurance for all-round financial security.

What’s Covered

Critical illness insurance protects you against serious and long-term health problems. Each policy is different, but some of the conditions include:

- Heart attack

- Stroke

- Cancer

- Limb loss

- Organ failure

- Neurological conditions (multiple sclerosis, Parkinson’s disease, etc.)

Critical illness insurance doesn’t cover short-term illnesses, and there may be some exclusions. For instance, pre-existing medical conditions might not be covered.

Remember, exclusions and conditions vary between policies and providers. For full details, please speak to an adviser or read the policy provider's terms and conditions.

How much critical illness cover do you need?

The amount of coverage you need depends on several factors, such as your income, expenses, and debts.

Use our critical illness to help determine how much cover you need from your critical illness policy.

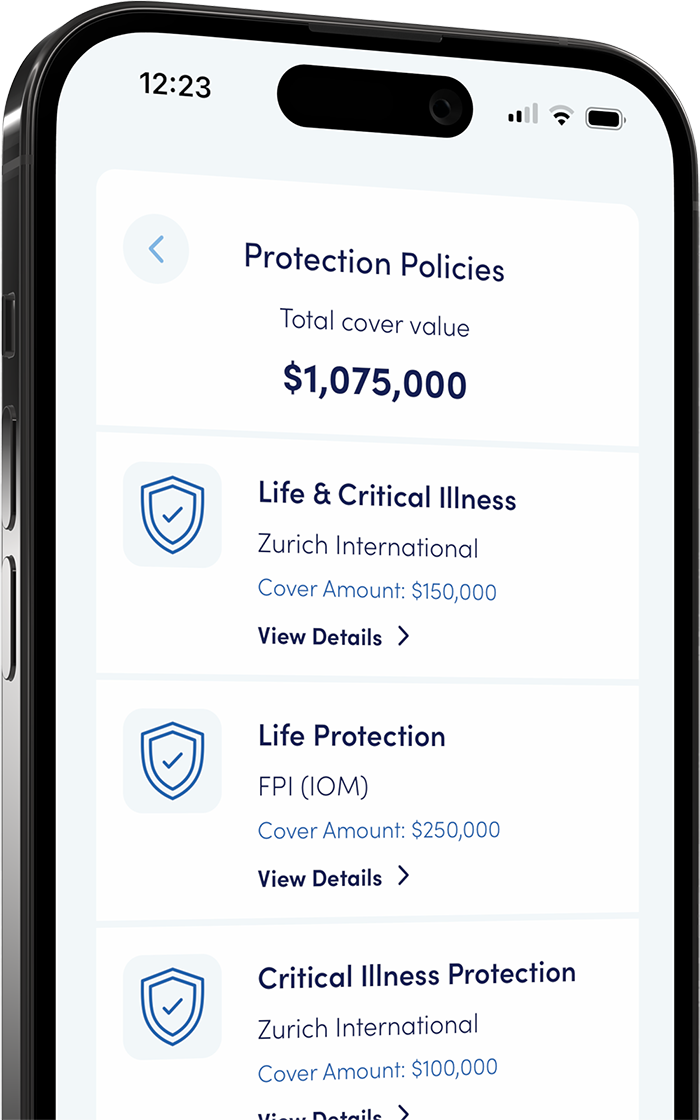

How critical illness cover works

Protecting your income is straightforward. Here’s how it works:

Choose your policy

Decide how much you’d like to be covered for and how long you want your policy to last.

Pay monthly

Keep making monthly payments for as long as your policy lasts to keep it active.

Receive a lump sum

If you’re diagnosed with a serious illness covered by your policy, the insurer will pay out a lump sum.

Start protecting your future today

A serious illness can happen when you least expect it. But with the right cover in place, you can be prepared. Speak to Holborn to find a critical illness insurance plan that fits your needs.

Critical Illness Insurance FAQs

Most policies protect you against serious illnesses like cancer, heart attack, stroke, multiple sclerosis, and major surgery. Coverage details can differ between providers. Our advisers are here to help you compare your options and choose the best policy.

The cost of critical illness insurance depends on factors such as your medical history, the type of policy and coverage, and your age. In the UK, the average cost of critical illness cover is around £25 per month, based on a £50,000 lump sum payout. Average monthly premiums are around £9 at age 25 and increase to £59 at age 50.

Critical illness cover provides a payout if you are diagnosed with a covered illness. Life insurance, on the other hand, pays out when you pass away. Many people opt for life insurance with critical illness coverage for broader protection.

If you have dependents, financial commitments, or limited savings, critical illness insurance could be a good choice. It can help you keep up with expenses and maintain your lifestyle if you cannot work or need time to recover.

Yes, you can have both. Health insurance covers your medical treatment, while critical illness insurance gives you a cash payout if you cannot work or need extra time to recover.

The right amount of cover depends on your income, expenses, debts, and family situation. Our experts can help you choose a policy that fits your needs and gives you peace of mind.