What’s New for UK Inheritance Tax?

Posted on: 25th April 2016 in

Retirement Planning

The law on UK Inheritance Tax (IHT) changes in 2017.

The government is introducing a new tax allowance called a ‘transferable (or additional) main residence nil-rate band (RNRB)’ on top of the existing ‘general’ inheritance tax nil-rate band.

As from 6

th April 2017, UK homeowners will enjoy an extra £100,000 free from Inheritance Tax – provided the property is being passed to a direct descendant. And the value of this tax-free ‘RNRB’ will be rising year-on-year to hit £175,000 in 2020.

How will this impact the UK expat?

Here at

Holborn Assets, we review the change to UK Inheritance Tax planned for 2017 – and highlight how you can play the long game with ace IHT planning.

I am a UK expat living in the UAE. Do I have to pay Inheritance Tax back in the UK at all?

The short answer is ‘probably’. Whether you work abroad or not you will be liable to IHT if you are judged to be of UK domicile status. This is likely to be the case unless you have previously tackled for yourself the giant job of establishing non-domicile status.

To paraphrase

expertsforexpats.com, “It is essential to understand that [even if you are] classed as a non-resident in the UK for tax purposes, [unless] your [UK] domicile [status is] changed, you will still be liable for UK Inheritance Tax.”

So that’s the bad news.

The good news is that, as from next year, UK Inheritance Tax is going soft on homeowners.

What’s the Inheritance Tax situation now?

If you are classed as a UK domicile and are worth more than £325,000, your estate will be liable to inheritance tax of 40% in the event of your death.

Conversely, this means that right now, estates below a value of £325,000 are free of IHT. If you die, you can pass on any proportion of your estate valued at less than this figure without being subject to Inheritance Tax. This, in taxation lingo, is your existing nil-rate band.

If you are married, any or all of this nil-rate band of £325,000 is transferrable to your spouse or civil partner if she/he survives you and you have left capacity unused.

New Inheritance Tax legislation – perks for passing property to family

Going live in 2017 is Inheritance Tax legislation first announced back in the 2015 Budget which will, according to the

government, “reduce the burden of IHT for families by making it easier to pass on the family home to direct descendants …”

The government’s new tax measure adds, as a booster to this nil-rate band, another concession. In taxation lingo, this is known as an ‘additional, transferable main residence allowance’ which is applicable to the value of your family home.

How will the new Inheritance Tax system look?

It is clear that from April 6, 2017, the new UK Inheritance Tax system gives you – the homeowner – an additional nil-rate band on top of your existing nil-rate band.

The

government explains that, “this measure introduces an additional nil-rate band when a residence is passed on death to a direct descendant … [or] … when a person downsizes or ceases to own a home.”

The value of this nil-rate band will rise as the scheme is phased in over time – starting at £100,000 in FY 2017/18 and rising to a total of £175,000 in FY 2020/2021.

So, for the next financial year, the

government says “the additional RNRB [of £100,000] would be applied together with the available RNRB [of £325,000].”

In practical terms, this means that, in FY 2017/18, single homeowners will not pay Inheritance Tax on properties worth less than £425,000 if the property is passed on to a direct descendant.

What’s more, the

new RNRB is set to rise in value every year until 2020/21. The

existing nil-rate band has been locked in at £325,000 for the same period.

Married couples can combine their nil-rate band status – and also pass on any unused nil-rate band capacity to their partner in the event of their death. This means that – according to the new IHT structure – by 2020, married couples will not pay IHT on properties worth £1m if they are passed onto descendants.

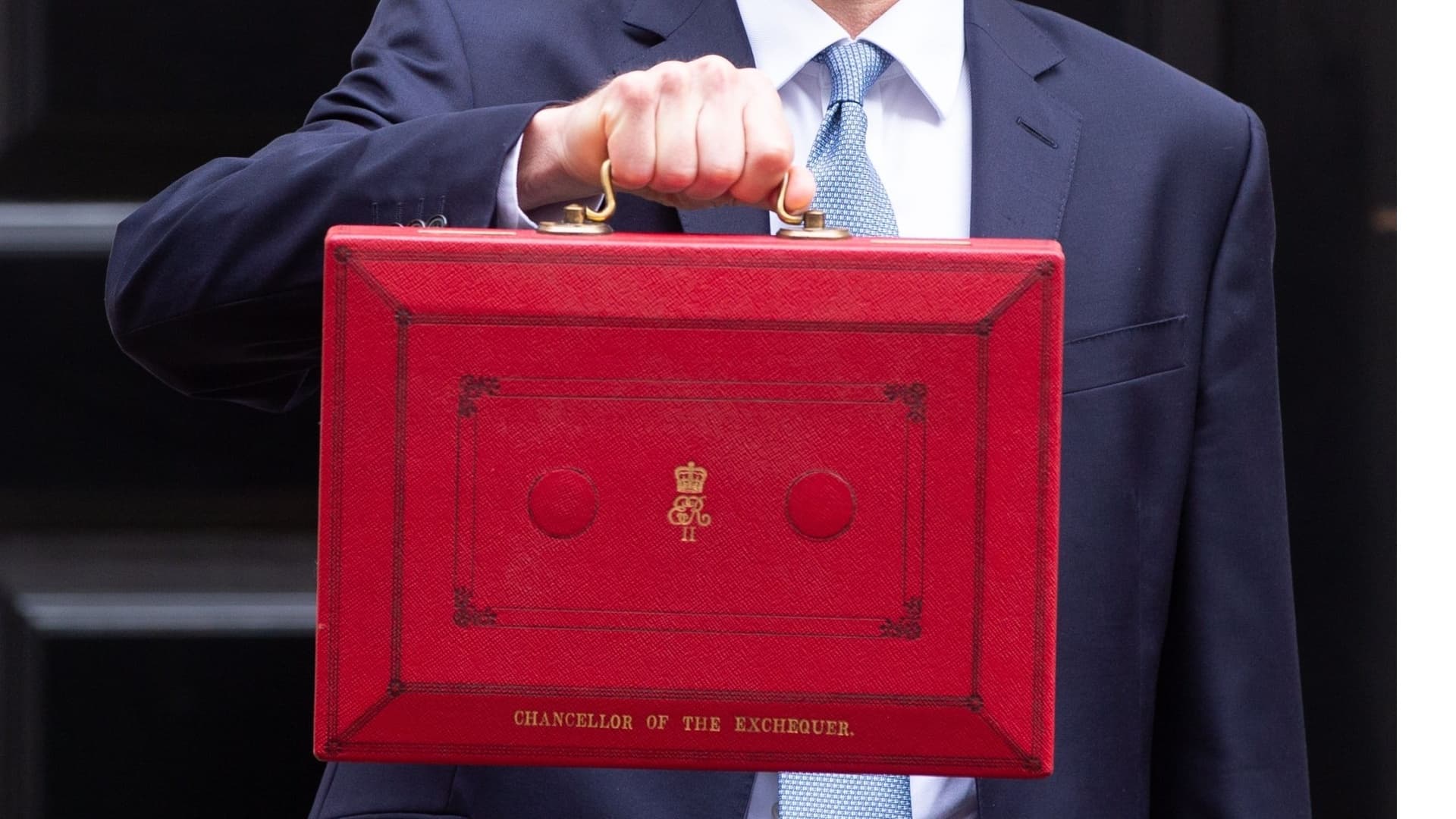

The Exchequer surmises that the new IHT scheme will be costing the UK government £940m a year by 2020.

What can I do right now to ace my Inheritance Tax?

Here at

Holborn Assets, we advise one thing when it comes to IHT planning: listen to advice!

Get yourself a guide who can give you advice which you can trust. There are so many options available to stay ahead of the IHT game, and a methodical plan by somebody with experience is invaluable. You need an independent financial advisor and a plan.

A basic IHT mitigation plan might centre on giving away what you can,

whilst you can, with the support of specific financial products.

Even in the simple area of gifts, the need for some expertise at your shoulder become immediately obvious – the HMRC has four classifications for gifts, each with different implications for your IHT. Talk to somebody who knows how it all fits together.

Factors to discuss include:

- You can give £3k a year tax-free and as much as you like to charities and political parties.

- Moving gifts into trusts does not offer the protection it once did, but it remains a specialist option.

- Gifts given seven years before death are not liable for Inheritance Tax. But what if the donor makes a substantial gift and then dies shortly afterwards? The law says the recipient of the gift must pay IHT. In this case, insurance can be bought by the recipient to cover any liability.

A structured IHT plan is likely to go beyond gifts. Two key areas to look at immediately would be tweaking your life assurance policy so the proceeds do not end up forming part of your estate and, in a different area, seeing if your pension pot is in the sunniest spot it can be.

* * *

Expert, independent advice is an absolute necessity in tax planning. Here at Holborn Assets, we do not recommend taking any action relating to your Inheritance Tax status without first talking to an independent financial advisor. There are exciting opportunities to be taken, but daunting complexities to master.

Get in touch with a

qualified financial advisor at Holborn Assets, today!