TSB Crisis enters Week 2

Posted on: 29th April 2018 in

Finance

“I don’t want to b with TSB!”

Thousands of angry TSB customers have taken to social media to vent their frustration over the bank’s botched IT migration last weekend, and the bank’s failure to rectify the damage since.

Customers have described being stranded on holiday, unable to access accounts to pay staff, and unable to pay bills and withdraw essential cash. Even more worryingly, some customers reported being able to see strangers’ account information in a suspected data breach.

What went wrong?

Bosses at TSB were congratulating themselves last Sunday evening about what they thought was the seamless transfer of 1.3 billion customer records to a new platform. Celebrations were cut short when problems started only 20 minutes after what the

Financial Times called “one of the most complicated IT migrations in European history.”

Shortly after the transfer, a small number of customers (TSB says only 400 out of 5.4 million clients were affected) logged on to their accounts only to find the details of someone else’s account on the screen.

TSB responded by shutting down its systems and when the bank re-opened on Monday morning it was entirely unprepared for the number of customers trying to gain access to their online accounts.

Stressed TSB staff in the Sunderland call centre were (apparently) fed fruit to keep up their energy levels as they dealt with an onslaught of worried and angry customers unable to access their accounts to perform essential transactions.

By Wednesday, TSB was facing questions from regulators and politicians amidst a social media frenzy.

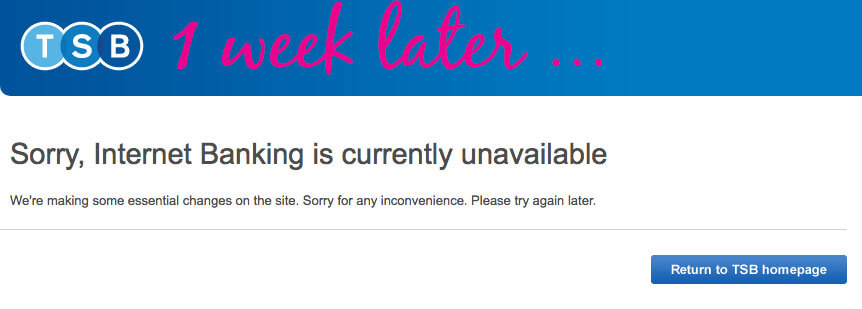

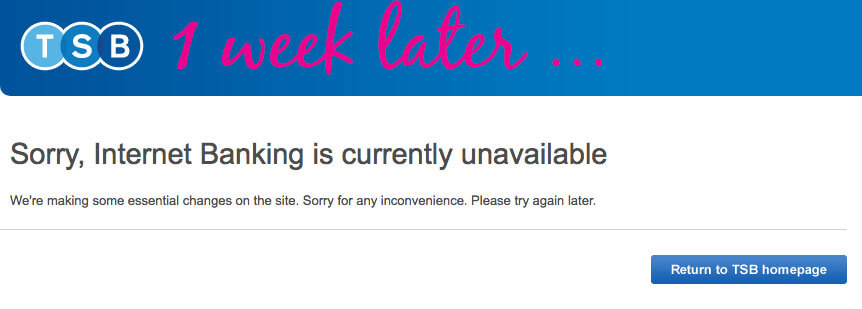

Six days later and

only half of TSB customers can access their Internet accounts, admits the bank, although its mobile app is functioning at 90% capacity.

TSB has responded by reassuring customers that they will be fully compensated if they were left out of pocket, no doubt fearing an exodus of current account customers.

A bigger problem?

TSB’s IT woes have furthered concerns over whether the technology is sufficient to safeguard customers as banking services become increasingly digitalised, and banks migrate to new platforms. Nick Hammond, lead adviser for Financial Services at World Wide Technology, an IT consultancy firm, said “the crisis at TSB provides a great case study for the problems presented by the sheer complexity of many banking IT systems…such issues are unlikely to be limited to TSB.”

Indeed, RBS was fined £56m for an IT debacle in 2014 that left millions of customers without access to their accounts.

As the UK welcomes in a new era of

open banking, this latest IT fiasco raises fresh concerns over how well-equipped these new platforms are to safeguard customers’ privacy.

Have you been affected?

So what can you do if you are one of TSB’s many disgruntled customers? Perhaps you found yourself unable to pay a bill, or unable to settle your overdraft, and are worried about how this may affect your credit rating? Read on…….

Am I entitled to compensation if I couldn’t pay a bill?

You can claim compensation for any losses incurred as a result of not being able to pay a bill. Customers affected in this way should keep a record of what’s happened and any receipts or invoices that show late payment charges, credit card interest etc.

You can send your information, including any evidence, to: Customer Relations, TSB Bank plc, PO Box 373, Leeds, LS14 9GQ, or use the

online complaint form, or call 0345 835 3844.

Am I entitled to compensation if my data was breached?

The short answer is yes, the law is in your favour, but you’d have to be pretty committed to get it. The law states that if a customer suffers damage or distress because a bank breached the Data Protection Act, they are entitled to compensation. That would mean taking TSB to court, which could prove both expensive and time-consuming.

Will my credit record be affected?

This is a possibility if you’ve had failed payments. Any customers affected in this way can ask TSB for written proof of their error to send to credit reference agencies.

How can I protect myself from fraud?

TSB says that it has contacted all of its customers who were affected by the data breach, so if you haven’t had an e-mail from them you can remain hopeful that you haven’t been affected.

However, if you log in and discover someone else’s details, you should take a screen shot and inform the bank. Make sure you ask for a secure email to send the information to and evidence from the bank that they have contacted the affected customer.

Sadly, if you spend the money you will be liable to pay it back by law. (We all wanted to know the answer to that one!)

Unsurprisingly, fraudsters love this kind of chaos as it’s the perfect time to scam people, so customers should also be more alert to any phonecalls, texts and emails from the bank in the near future. And criminals are perhaps more adept at using technology than the banks! Just because a text appears in an ongoing stream from your bank, doesn’t mean it’s legitimate.

Don’t share your details unless you are absolutely certain it is OK to do so.

Keep an eye on your bank statements for any suspicious activity and if you believe your data has been compromised, request a new bank account number.